open end mortgage bonds

Name A - Z View all businesses that are OPEN 24 Hours. Payments generally can be made anytime and this means that borrowers can pay off their mortgage much more.

What Are Mortgage Backed Securities Rocket Mortgage

As part of its bold and open-ended plan the Fed said it would spend 40 billion a month to buy mortgage bonds to make home buying more affordable.

. Name A - Z View all businesses that are OPEN 24 Hours. 495 19 Reviews 0 Recent. Bail Bonds in Buffalo NY Open 24 Hours.

After you buy the house. Definition in the dictionary English. An open-end mortgage is a type of home loan in which the total amount of the loan is not advanced all at once but rather used for future home-related improvements as.

With an open-end mortgage youll still be approved to take out the entire 400000 but youll only pay interest on the money you actually end up using. If the amount of additional bonds is restricted the mortgage is referred to as a limited. A bond that can be changed into a specified number of shares of the issuers common stock is called a.

Find a Lender Now. Open-end mortgage A mortgage that permits the issuer to sell additional bonds under the same lien. An even more conservative version is the limited open-end mortgage which usually contains the same restrictions as the open-end but places a limit on the amount of first mortgage bonds.

In an 111 vote the Federal Reserve decided to. Bail Bonds Companies in Buffalo NY Open 24 Hours. View US markets world markets after hours trading quotes and other important stock market activity.

Stock market data coverage from CNN. An open-end mortgage is a type of mortgage that allows the borrower to increase the amount of the mortgage principal outstanding at a later time. 0 Bank of America NA.

Michele Morse Reen NMLS 304120. Open-end mortgage saves borrower the effort of going somewhere else in search of a loan. Find a mortgage lender on Zillow in minutes.

An open-end mortgage on the other hand can be repaid early. La Fed dijo que gastará 40000. It is a type of rotating credit wherein the borrower is entitled to get top up on the same.

- An Open-end Mortgage Bond issued by a corporation is one in which the property used to secure the bonds can be used to secure additional bonds and all bonds rank equally. Match all exact any words. A mortgage loan that may allow future advances as the value of the property increases up to a certain percentage of loan-to-valueThe legal problem with this arrangement.

United States Net Purchases Of Us Treasury Bonds And Notes September 2022 Data

Should You Overpay On Your Mortgage Or Invest Your Money Nextadvisor With Time

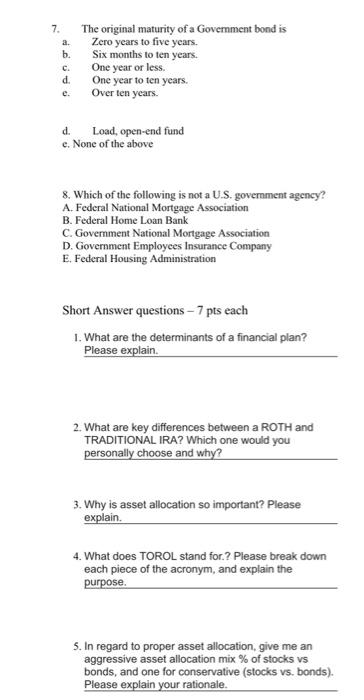

Solved 7 The Original Maturity Of A Government Bond Is A Chegg Com

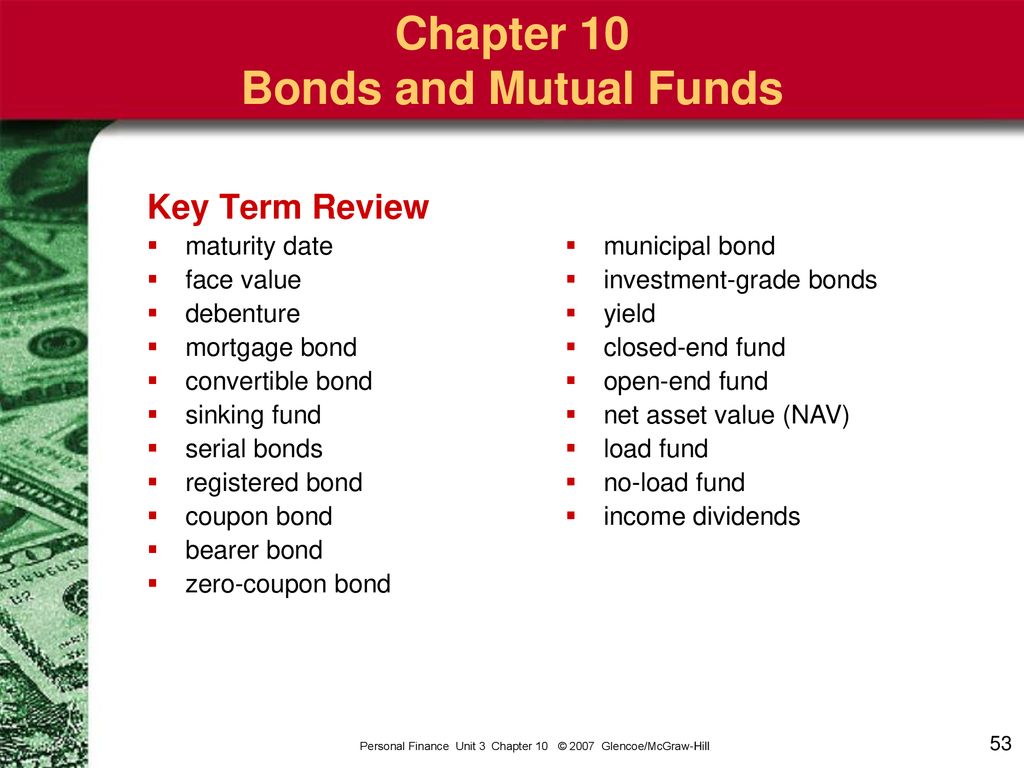

Personal Finance Unit 3 Chapter 10 C Glencoe Mcgraw Hill Ppt Download

Etf Vs Mutual Fund What S The Difference Ally

What Is A Mortgage Bond Moneytips

Mbs And Cmos Fixed Income Raymond James

How Does The Mortgage Loan Process Work Rate Com

Historical Mortgage Rate Trends Bankrate

How Bond Yields Drive Fixed Mortgage Rates Financial Pipeline

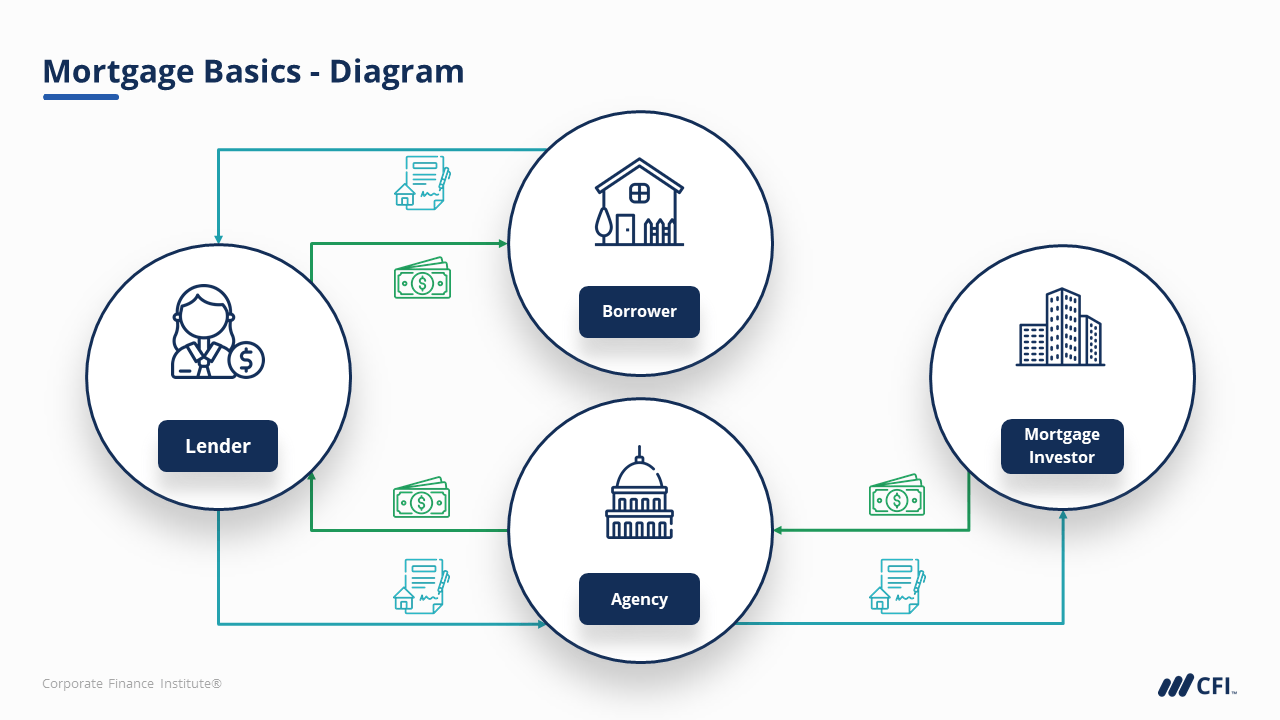

Securitized Products I Finance Course I Cfi

:max_bytes(150000):strip_icc()/what-are-bonds-and-how-do-they-work-3306235_V3-cc55a8d3b82d4d34a991d6cc4fa8a865.png)

What Are Bonds And How Do They Work

Fed Rate Hikes Why Are Bond Yields Falling Charles Schwab

Slides By Pamela L Hall Western Washington University Francis Ibbotsonchapter 5 Primary Securities And Their Issuers1 Primary Securities And Their Ppt Download

Types Of Bonds Bond Yield Ppt Download

Open End Mortgages A Comprehensive Guide Smartasset

Mortgage Sale Yield Increases The New York Times

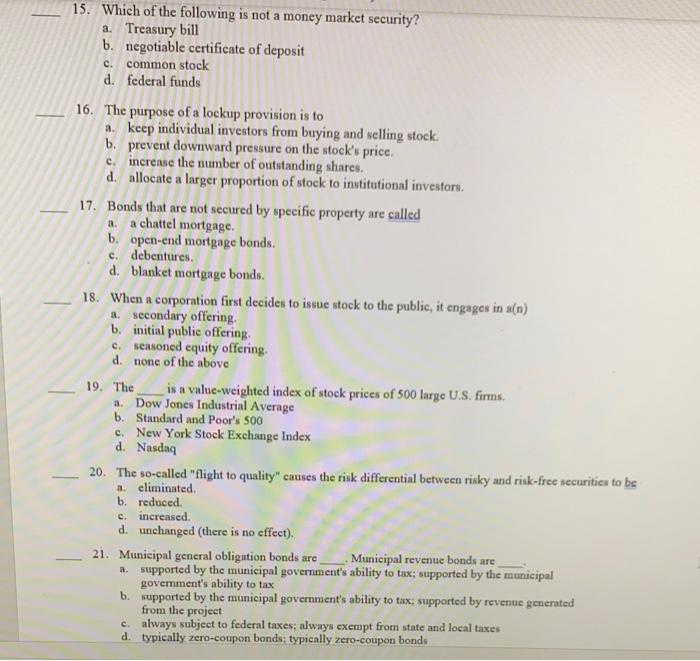

Solved 15 Which Of The Following Is Not A Money Market Chegg Com